Introduction

While Africa has recorded far fewer cases as compared to other continents, with a little more than 1.2 million cases and 28,000 deaths as of 25 August 2020,[1] the impact of Coronavirus on African businesses is still significant. International Economics Consulting Ltd (IEC). jointly collaborated with the African Trade Policy Centre (ATPC) of the United Nations Economic Commission for Africa (ECA) to conduct two surveys,[2] separated by a 3-month gap to take stock of the effect of Coronavirus on businesses and trade, as well as identify the remedial actions taken by the private sector. The change in outlook and perceptions of firms surveyed between April and July 2020 reveals some paradigm shifts.

Coronavirus Challenges

In April 2020, lockdowns and movement restrictions impacted most of the businesses surveyed and affected their ability to operate at normal capacity. The statistical breakdown of people’s mobility released by Google for 27 of Africa’s 54 countries, suggests that 24% of the population stayed at home above the normal baseline measured from pre-pandemic conditions.[3]

Note: Chart shows 3 days rolling average change in staying at home for African countries.

Source: Google

Firms, whether in the goods or services sector, faced a sharp drop in demand, and a drain on their cash flow thus leading to a growth in demand for financial assistance.

By July, some of the African firms surveyed resumed operations and their topmost concern shifted from having their businesses closed to the inability to undertake business development. Generating new leads became their primary challenge. The drop in demand for goods and services, together with cash flow issues persisted as top challenges in the April and July surveys.

Note: Infographic shows a shift of top challenges faced by African businesses from April 2020 to July 2020.

Source: IEC-UNECA (2020)

Impact of Coronavirus on employment

Most companies did attempt to maintain operations despite the lockdowns by having their employees working from home, but many firms quickly reversed the remote work. In April, 40-50% of the workforce was working from home and this figure decreased by almost half in July to just 20-30%. Many firms even saw benefits in having people not coming to the office every day, as they adopted hybrid models with employees splitting their working hours between the office and home.

Even if the mobility restrictions were alleviated in most African countries, capacity utilisation across firms improved only slightly from April to July, remaining in the 40-50% range. An uptake in activity was noted in the goods sector, as well as for Micro, Small & Medium Enterprises (MSMEs), where capacity utilisation shifted from the 30-40% up to 40-50%.

Coronavirus’s disruption to supply chains

Border closures and shipment delays have disrupted the supply of goods and services to firms. These disruptions accrued from April to July 2020, with the shortage of supplies rising from over 35% to 56%. Many firms were thus forced to look for alternatives suppliers. Impressively, up to 72% of them found new local suppliers and 62% found new international suppliers. The relief was short-lived though as unfortunately as many of the new suppliers unfairly imposed high prices. Hence, not surprising that 87% of the firms surveyed plan to return to their original suppliers post-Coronavirus.

Support from Government and Financial Institutions

The general sentiment regarding government support has not changed much between April and July 2020 with less than half of African businesses surveyed being satisfied with the response from their governments to the crisis. The majority of the businesses were expecting the postponement of tax payments and the provision of capital to support their financial struggle.

The limited support by some governments has compelled 42% of African firms in April, rising to 50% in July, to seek help from financial institutions such as Commercial Banks, State Banks, and Microcredit agencies. Commercial banks remain the main financial institution to be approached, with 44% of the requests. It is interesting to note that more and more companies are turning towards microcredit agencies.

The main use of financial support was to address working capital shortfalls. However, it was reported that the majority were desperately awaiting updates from the financial institutions. Even among the one-quarter of those that received positive answers, some firms are complaining about high-interest rates and the delays in the processing of their claims.

Outlook

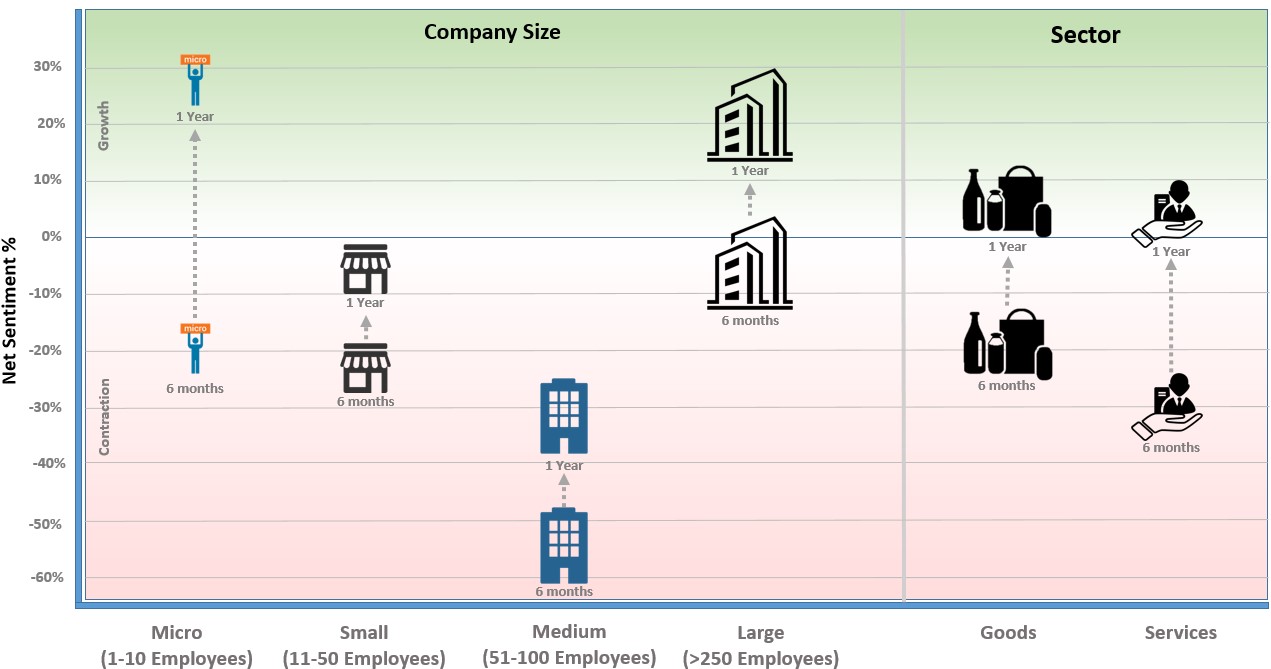

The perceived outlook for the next 6 months is relatively negative but looks more promising longer-term. Survey results show that the perception has not varied too much in the three months between April and July 2020. Micro as well as large firms consulted, predict that growth will only happen after 9 to 12 months. Of course, the feedback from firms is based on the assumption that the pandemic will be controlled in the coming months and that countries do not suffer major long-term lockdowns from second waves.

Perceived outlook of African businesses

Figure: the Infographic shows the net sentiment of businesses on their outlook for the next six months and one year, as of July 2020

Source: IEC-UNECA (2020)

Business Opportunities and Innovations

African businesses have not remained arms crossed and are looking to rise to the challenges brought by the pandemic. It is pleasing to note that two-thirds of surveyed firms have identified new business opportunities with a clear objective of growing their markets. Many are looking at shifting towards new technologies and online platforms such as online selling, virtual training, e-commerce websites.

An interesting observation is that 78% of the MSMEs were inclined to look for new business opportunities as compared to only 53% of larger companies. Sectorwise, three-quarters of firms involved in the goods sector are thinking about new business opportunities, as compared to 56% of those involved in the services sector.

However, to implement these new strategies most of these companies need support either in terms of funding, partners, or sponsors to execute their plan. As highlighted by a CEO from the hospitality sector, which was running at 51% capacity in July 2020, “we would like to try and find sponsors and influencers to promote our products online.”

Conclusion

Even if African countries have a comparatively less number of cases than other continents, they are still suffering from the global disruptions of the pandemic. In June 2020, Ngozi Okonjo-Iweala, ex-finance minister of Nigeria, and former managing director of the World Bank was fearing the pandemic could even wipe out up to two or three decades of growth and development in Africa.[4]

July 2020 has seen improvements as compared to April 2020 in terms of an increase in capacity utilisation and resumption in business operations. Firms are rising to the challenge by looking at innovative solutions and strategies to maintain and grow their business. There is a belief that there could be a unique opportunity to promote the growths of small and medium-sized enterprises (SMEs) on the African continent.[5] Cloud and online platforms have been identified as supporting this endeavor. However, African firms need support from either the government, partners, sponsors, or financial institutions.

Several African governments have responded by creating Coronavirus funds. Philanthropists and businesses have been invited to contribute. Still, it is expected that most of these funds will be used to strengthen the healthcare systems and provide assistance to vulnerable members of society, instead of job creation and recovery through support to the private sector.

Challenging times lie ahead for the continent where a high proportion of the workforce depends on the informal economy and earns their living on a day-by-day basis.

Paul Baker

CEO INSIGHTS

International Economics Consulting Ltd is an independent international management consultancy firm, specialised in providing strategic advisory services in the field of trade, investment, and public policy. The company has partnered with the United Nations Economic Commission for Africa (ECA) analysing the impact of Coronavirus on African economies and also engaged with the World Bank in finding solutions for Coronavirus recovery through trade. IEC has also developed a platform sharing knowledge on the economic impact of the coronavirus on international trade. Our analyses are prepared by our expert consultants and our analytics team, assisted by existing scientific or internally developed data models fed from publicly available and collected data.

References:

[1] World Health Organisation’s data – https://covid19.who.int/

[2] First Survey – April 2020 – https://tradeeconomics.com/covid19-african-business-mauritius/

Second Survey – July 2020 – https://tradeeconomics.com/reactions-and-outlook-to-covid-19-in-africa-july-2020/

[3] The baseline is the median value, for the corresponding day of the week, during the 5-week period Jan 3–Feb 6, 2020.

[4]https://www.weforum.org/agenda/2020/06/covid-19-africa-lockdown-recovery-ngozi-okonjo-iweala-nigeria-former-finance-minister

[5]https://www.weforum.org/agenda/2020/06/strengthening-africa-s-best-pandemic-defense/